On november 10, 2021, the internal revenue service (irs) announced that employees can put aside up to $2,850 into their health care flexible spending accounts (health fsas) in 2022. Fsas only have one limit for individual and family health plan participation, but if you.

Flexible Spending Accounts How An Fsa Works Optum Financial Plans

They will have the option of allowing you to roll over all of your unspent fsa dollars into the next plan year.

What is fsa health care 2022. $5,000 per year per household; This provision allows an additional year to spend down all unused 2021 health care flexible spending account (hcfsa) balances. A prior client alert indicated that health flexible spending account (fsa) contribution limits would also remain unchanged, but on november 10 the irs released updated fsa limits for 2022.

The maximum contribution for dependent care fsas is $5,000 per household. The health care standard or limited fsa annual maximum plan contribution limit is projected to increase from 2750 to 2850 in 2022. Fsa limits were established with the enactment of the affordable care act and are set to be indexed for inflation each year.

Remaining balances for these fsas will be moved on march 1. Employers may make contributions to your fsa, but arent required to. $2,500 for married individuals filing a separate tax return;

The annual contribution limit for your health care flexible spending accounts (health fsas) is on the rise for 2022, according to the society for human resource management. This is an increase of $100 over 2021. At the end of 2022, the carryover will return to $570 which was previously $550.

The 2022 healthcare fsa contribution limit is an increase of $100 from the 2021 healthcare fsa contribution limit ($2,750), and the carryover limit is an increase of $20 from the 2021 limit ($550). Dependent care assistance plans (dependent care fsa) annual maximum (unless married filing separately): Under the caa, employers are allowed, but not required, to permit the following for either or both of medical and dependent care fsas:

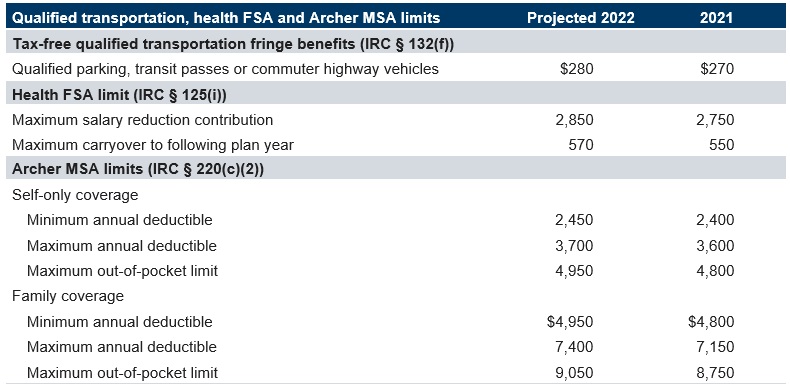

It's a smart, simple way to save money while keeping you and your family healthy and protected. The 2022 health fsa limit is $2,850 (up $100 from 2021). Law and policy group 2022 transportation, health fsa and archer msa limits projected august 18, 2021 mercer projects the 2022 limits for qualified transportation (parking and transit) benefits, health flexible spending arrangements (fsas) and archer medical savings accounts (msas) will increase.

For other 2022 maximums affecting. Employees can now contribute $2,850 to their fsa, which is $100 more than the $2,750 cap in 2021. As set by the internal revenue code, the dependent care fsa limits for 2022 are $5,000 for married filing jointly or single, and $2,500 for married filing separately.

Dependent care flexible spending account. You dont pay taxes on this money. *for the health care and limited purpose health care fsa, the standard $550 carryover was moved over in january 2021.

Flexible health spending accounts, or f.s.a.s, let employees set aside pretax money from their paychecks to help pay for medical and dental care that insurance doesnt cover. The new fsa legislation gives employers the option of waiving your fsa deadline for 2021. The 2022 fsa carryover is $570 per year, which is up $20 from 2021.

This means that all 2021 hcfsa balances that were greater than $30 on december 31, 2021, can now be used to pay for 2022 incurred expenses. So you can still contribute the full amount for 2022 and have your remaining 2021 fsa funds left to spend. The 2022 fsa contributions limit has been raised to $2,850 for employee contributions (compared to $2,750 in 2021).

Allowing a full carryover of hcfsa funds from 2021 to 2022. New for december 31, 2021 only: The contribution limits for 2022 are:

What happens to the standard $550 carryover for the health care and limited purpose health care fsa as a result of the unlimited carryover? Carryover of all unused funds from plan year ending in. The 2022 dcap (also known as dependent care fsa) contribution limits decreased from $10,500 in 2021 for families and $5,250 for married taxpayers.

Fsa participants set aside a portion of their paychecks. At the end of 2022, the carryover will return to $570 which was previously $550. Allowed expenses include insurance copayments and deductibles, qualified prescription drugs, insulin, and medical devices.

As a result, the irs just recently announced the revised contribution limits for 2022. Special rules for fsa rollover for 2022 due to the pandemic all unused fsa balances will automatically rollover from 2021 to 2022. Any unused balance as of year end in your healthcare fsa will rollover into 2022.

This account is used to reimburse you for dependent care expenses, such as child day care, elder care, etc. Any unused fsa dollars at the end of the year can be used until march 15 th, 2023 to pay for 2022 eligible expenses bek health care fsa pay for eligible medical, dental or vision expenses (deductibles, copays, rx such as insulin, otc medications) if you enroll in the bek ppo medical plan The 2022 limits, as compared to the 2021 limits, are outlined below:

This means youll save an amount equal to the taxes you would have paid on the money you set aside.

Limited Purpose Fsa Lpfsa Optum Financial

What Is A Dependent Care Fsa Wex Inc

Fafsa Checklist Fafsa Checklist Create Yourself

Health Insurance Costs Understand What You Might Pay If You Have A Health Insurance Plan With Health Insurance Plans Supplemental Health Insurance Work Health

New Year New Eyeglasses Dont Let Your Fsa Dollars Expire - Ray-ban Email Archive Ray Bans Ray Newsletter Design

2022 Transportation Health Fsa And Archer Msa Limits Projected Mercer

Flexible Spending Account Nuesynergy

Collect Printable Firefighter Shift Calendar Calendar With Jfrd 2022 Shift Calendar In 2021 Calendar Printables Calendar Template Print Calendar

2022 Fsa Limit - Lawley Insurance

Hsa Vs Fsa - Millennium Medical Solutions Inc Healthcare

Pin On Money

Get The Filing The Fafsa Book For Free Edvisors Fafsa Life After High School Free Books

Zhtvobsyufwvmm

Arrow Elegant Event Ticket Template Event Ticket Template Ticket Template Ticket Design Template

Pin On Everything Baby

Family Planning How Fsa And Hsa Can Help You Save

2022 Limits For Fsa Commuter Benefits And More Announced Wex Inc

V7yhfpdsa2bj8m

Pin On Diabetes Care

What Is Fsa Health Care 2022. There are any What Is Fsa Health Care 2022 in here.